Predictive markets have shown a 70–75% accuracy rate

This week, I decided to talk something a tiny bit different. More technical, but extremely useful in these times of volatility and changes.

There are tools that distills collective intelligence into actionable insights - predictive markets.

It allows people to bet (actual money) on the likelihood of future events, ranging from political outcomes to industry shifts, creating a real-time pulse of probabilities driven by human intuition and hard data.

While these platforms might seem niche, their potential for CEOs and business leaders is enormous.

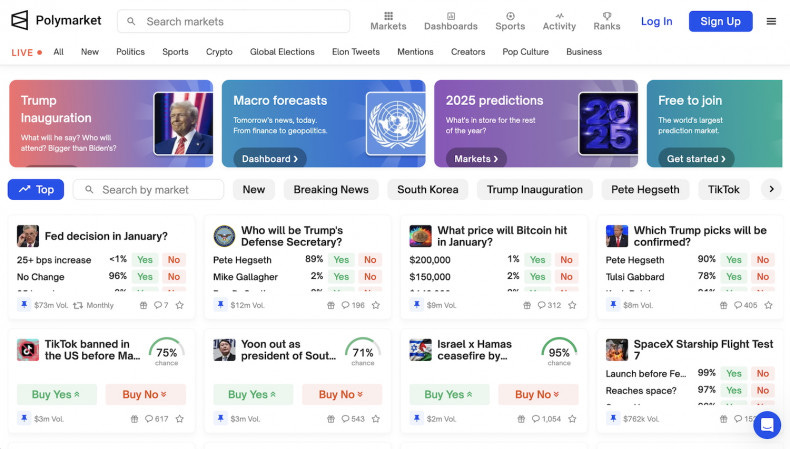

What is Polymarket?

I’m just highlighting that this is article is not sponsored in any way by Polymarket. I’m just presenting a platform that I find extremely valuable and interesting.

Polymarket is a predictive market platform, where participants buy and sell shares based on their belief in a future event's outcome. For example:

- Will inflation drop below 4% by mid-year?

- Will a specific candidate win the next election?

The prices of these shares fluctuate, reflecting the collective probability assigned to each outcome. A share priced at $0.70 implies a 70% chance of that event happening.

These markets are driven by incentives, insights, and the aggregation of diverse perspectives.

Why predictive markets are surprisingly accurate

Predictive markets, like Polymarket, often outperform traditional forecasting tools such as polls or expert opinions. Here’s why:

1. Wisdom of crowds

The concept is simple: when a large group of people contributes insights, their aggregated prediction is often more accurate than that of individual experts. Polymarket harnesses this principle by:

- Aggregating diverse perspectives.

- Filtering out extreme views through the collective average.

- Predictive markets have shown a 70-75% accuracy rate for political elections and other well-defined events, frequently outperforming polls.

2. Financial incentives drive precision

Unlike surveys or polls, participants in predictive markets are “skin in the game”.

Their money is at stake, motivating them to research and minimize emotional bias.

This mimics real-world decision-making. Whether investing capital or pivoting strategies, financial stakes drive accountability.

3. It’s dynamic and adaptive

Unlike static forecasts, predictive markets continuously adjust as new information emerges. If a new trend or development surfaces, the market reflects it in real time.

When predictive markets shine

Predictive markets excel in certain scenarios:

- When the events are well-defined: clear, binary outcomes, such as election results or policy decisions.

- When we’re talking about markets with access to reliable and abundant data.

- When there’s a wide participation: a broad mix of contributors reduces individual biases and ensures more reliable results.

But, there are challenges and limitations

While Polymarket is fascinating, it’s not without its flaws.

CEOs need to be aware of these before applying its insights to their strategies.

1. Bias can creep in…

The "wisdom of crowds" only works when the crowd is informed and diverse. If participants share the same blind spots or are influenced by media hype, their predictions can be skewed.

2. Manipulation risks

Wealthy participants or insiders with privileged information can distort the market by placing large bets to sway probabilities.

3. "Black Swan" events

Markets are built on probabilities, not certainties. Rare, unpredictable "black swan" events - like COVID-19 - can render predictions irrelevant.

How leaders can leverage predictive markets

The real power of predictive markets lies in how leaders interpret and act on their insights. Here’s how you can use them to inform decisions:

1. Gauge market sentiment

Use platforms like Polymarket to understand public sentiment or forecast trends in your industry. For example:

- Predictive markets on regulatory decisions can offer early indicators of policy shifts.

- Markets on tech adoption can highlight which innovations are gaining traction.

2. Stress-test your strategies

Treat predictive markets as an additional layer of analysis. If you’re considering a major decision (like expanding into a new region) compare your internal forecasts with external predictive market data.

3. Monitor competitor moves

Predictive markets tracking industry developments can hint at competitors’ strategies. For example, if there’s speculation about an acquisition, watch how the market adjusts to assess its likelihood.

4. Assess risk in volatile situations

When navigating uncertainty, be it geopolitical tensions or market disruptions, predictive markets provide a barometer of real-time probabilities.

Why I’m personally fascinated by predictive markets

I like predictive markets because they blend human intuition with systemic analysis. They reflect the complexity of decision-making, where information, psychology, and incentives intersect.

For CEOs, it’s like having a dynamic compass. These markets don’t guarantee certainty, but they do offer a valuable layer of probabilistic insight, helping you ask better questions and avoid blind spots.

Predictive markets are not crystal balls, but they are powerful tools for decision-makers. By understanding their strengths and limitations, CEOs can integrate them into broader strategic frameworks.

- Use them to sense trends, validate assumptions, and test scenarios.

- Remain vigilant about biases, manipulation, and overreliance on single data points.

Leadership is not just about making decisions - it’s about making informed decisions.